Support & Resistance Mastery with RelicusRoad Pro

📊 Support & Resistance Mastery: Professional Trading Strategies

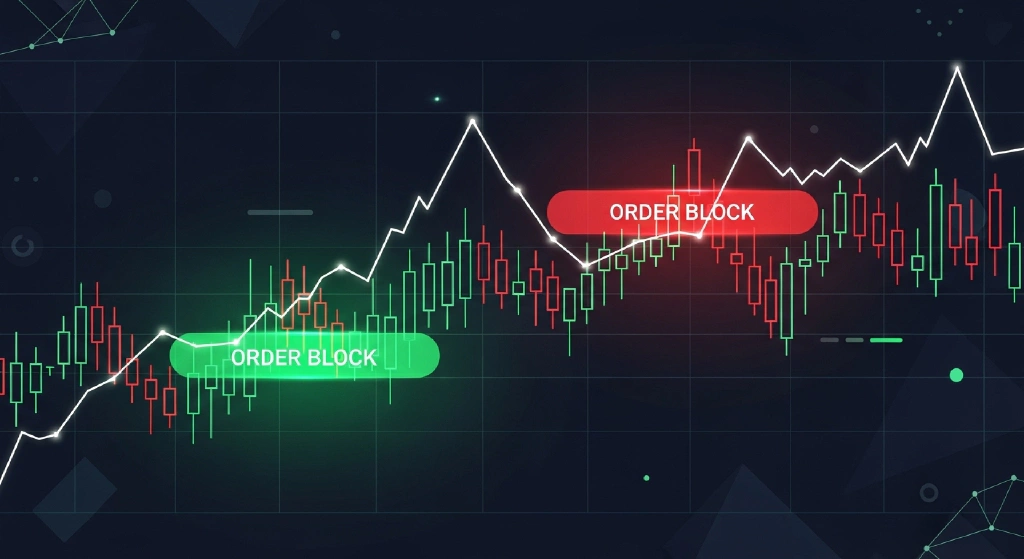

Support and resistance are fundamental concepts that every successful trader must master. RelicusRoad Pro’s S&R identification system helps you spot these crucial levels with clarity, enabling more confident trading decisions based on proven market psychology.

Understanding Support & Resistance Psychology

What Creates These Levels?

Support and resistance levels form when price action reverses and changes direction, leaving behind peaks or troughs in the market. These levels persist because of:

- Collective Memory: Traders remember significant price points where reversals occurred

- Order Clustering: Stop losses and take profits accumulate at round numbers and previous highs/lows

- Supply/Demand Imbalance: Areas where buying or selling pressure overwhelmed the opposite force

- Psychological Barriers: Round numbers (1.2000, 1.3000) create natural psychological levels

The Zone Concept

Pro Tip: Support and resistance are rarely perfect lines—they act more as zones where price action becomes volatile. Think in ranges, not exact prices.

This zone-based thinking is crucial because:

- Market noise creates minor penetrations

- Different traders see slightly different levels

- Liquidity hunting causes temporary breaks

- Bid/ask spreads affect exact execution prices

How RelicusRoad Pro Identifies S&R Levels

Multi-Level Classification System

Major Levels (Red Zones):

- Historical swing highs/lows from weekly/monthly charts

- Areas with multiple price rejections

- Round psychological numbers

- High-volume reversal zones

Intermediate Levels (Orange Zones):

- Daily and 4-hour chart swing points

- Previous day’s high/low

- Weekly pivot points

- Areas of price consolidation

Minor Levels (Yellow Zones):

- Intraday swing points

- Session highs/lows

- Short-term consolidation areas

- Recent breakout levels

Visual Clarity Features

RelicusRoad Pro enhances S&R identification with:

- Color-coded zones for quick recognition

- Automatic adjustment as new levels form

- Multi-timeframe overlay capabilities

- Clear labeling of level significance

Core Trading Strategies

Strategy 1: Zone Bounce Trading

Concept: Trade reversals from major S&R zones using price action confirmation

Setup Requirements:

- Price approaching major S&R zone

- Momentum slowing (divergence on RSI/MACD)

- Volume decreasing on approach

- Clear zone identified by RelicusRoad Pro

Entry Rules:

- Wait for price to enter the S&R zone

- Look for reversal candlestick patterns:

- Pin bars/hammers at support

- Shooting stars/dojis at resistance

- Enter on close of confirmation candle

- Stop loss beyond the zone (using ATR for buffer)

- Target opposite S&R level or use trailing stop

Risk Management:

- Risk maximum 1% per trade

- Use position sizing calculator

- Allow for zone width in stop placement

Strategy 2: Role Reversal Trading

Concept: When support breaks it becomes resistance (and vice versa)

The Psychology: As price moves past a level, supply and demand shift, causing the breached level to reverse its role. Previous buyers at support become sellers wanting to exit at breakeven.

Setup Requirements:

- Clean break of major S&R level

- Retest of broken level from opposite side

- Volume confirmation on initial break

- RelicusRoad Pro showing level flip

Entry Process:

- Identify strong level break with volume

- Wait for pullback to broken level

- Look for rejection at new S/R

- Enter with stop beyond the rejection

- Target measured move or next major level

Strategy 3: Range Trading

Concept: Trade between established support and resistance boundaries

Ideal Conditions:

- Clear horizontal S&R creating range

- Multiple touches confirming boundaries

- No strong trending conditions

- Range width of at least 50 pips (forex)

Execution Rules:

- Buy at support zone with stop below

- Sell at resistance zone with stop above

- Take partial profits at 50% of range

- Full exit at opposite boundary

- Avoid trades in middle of range

Strategy 4: Breakout Trading

Concept: Trade continuation after S&R levels break

Key Principle: The more times S&R is tested, the weaker it becomes. Multiple tests exhaust orders at that level.

Breakout Confirmation:

- Volume surge on break

- Candle closes beyond level

- No immediate reversal

- Momentum indicators confirming

Entry Options:

- Aggressive: Enter on break

- Conservative: Wait for retest

- Ultra-Conservative: Wait for higher high/lower low after break

Multi-Timeframe S&R Analysis

The Professional Approach

Start from Higher Timeframes:

- Monthly/Weekly: Major institutional levels

- Daily: Primary swing levels for position trades

- 4-Hour: Intermediate levels for swing trades

- 1-Hour: Entry refinement

- 15-Min: Precise entry timing and stop placement

Confluence Recognition

The strongest S&R zones have multiple confirmations:

- Previous support/resistance at same level

- Fibonacci retracement alignment

- Moving average convergence

- Round number proximity

- High volume node (if volume data available)

Example Multi-Timeframe Analysis:

EUR/USD at 1.0950:

- Weekly: Major support from 2023 low

- Daily: 50% Fibonacci of recent swing

- 4H: Previous resistance turned support

- 1H: Rising trendline confluence

Decision: High-probability long setupRisk Management Essentials

Position Sizing Rules

The 1% Rule: Never risk more than 1% of account on single trade

Calculation Example:

- Account: $10,000

- Risk per trade: $100 (1%)

- Stop loss: 50 pips

- Position size: $100 ÷ 50 = $2 per pip

Stop Loss Placement

Use ATR for Objective Stops:

- Calculate Average True Range

- Place stop 1.5-2x ATR beyond S&R zone

- Accounts for normal market noise

- Prevents premature stop-outs

Avoid These Stop Loss Mistakes:

- Placing stops at exact S&R levels

- Using same pip distance for all trades

- Ignoring market volatility

- Clustering with obvious retail stops

Profit Taking Strategies

Fixed Risk/Reward:

- Minimum 1:2 risk/reward ratio

- Take partial profits at 1:1

- Move stop to breakeven

- Let remainder run to full target

Dynamic Exits:

- Trail stop using opposing S&R levels

- Exit on momentum divergence

- Close on opposite signal formation

- Use time-based exits for ranges

Common S&R Trading Mistakes

❌ Mistake #1: Line Thinking

Problem: Treating S&R as exact lines instead of zones

Solution: Always consider S&R as areas with buffers

❌ Mistake #2: Ignoring Timeframe

Problem: Using 5-minute S&R for daily trades

Solution: Match S&R timeframe to your trading style

❌ Mistake #3: Fighting Major Levels

Problem: Repeatedly trading against strong S&R

Solution: Respect major levels until clearly broken

❌ Mistake #4: Overcomplicating Charts

Problem: Drawing too many S&R levels

Solution: Focus on 3-5 major levels maximum

❌ Mistake #5: Ignoring Market Context

Problem: Trading S&R in isolation

Solution: Consider trend, momentum, and volume

Practical Trading Examples

Example 1: Support Zone Bounce

Setup: GBP/USD approaching 1.2500 major support

- RelicusRoad shows red zone at 1.2480-1.2520

- Daily RSI showing oversold (<30)

- Pin bar forms at 1.2495

- Entry: 1.2510 on pin bar close

- Stop: 1.2470 (below zone)

- Target: 1.2600 (next resistance)

- Result: 90 pip profit (2.25:1 RR)Example 2: Resistance Break and Retest

Setup: USD/JPY breaks above 150.00 resistance

- Clean break with volume spike

- Pullback to 150.00 after 2 days

- Bullish engulfing at new support

- Entry: 150.20 on confirmation

- Stop: 149.70

- Target: 151.00 (measured move)

- Result: Target achievedIntegration with Other RelicusRoad Features

Powerful Combinations

S&R + Road Levels:

- Double confirmation at key zones

- Enhanced probability setups

- Better risk/reward opportunities

S&R + Signal Lines:

- Trend direction confirmation

- Entry timing optimization

- Dynamic exit strategies

S&R + Market Sessions:

- Focus on active session S&R

- Avoid low-liquidity false breaks

- Time entries with session opens

Building Your S&R Trading Plan

Daily Routine Checklist

Pre-Market (15 minutes):

- Mark daily/weekly S&R levels

- Note yesterday’s high/low

- Identify potential setup zones

- Check economic calendar

During Market:

- Monitor price action at zones

- Wait for confirmation signals

- Execute with proper position size

- Set alerts for zone approaches

Post-Market Review:

- Screenshot successful/failed trades

- Journal entry/exit reasoning

- Update S&R levels if needed

- Plan tomorrow’s focus zones

Performance Tracking

Track these metrics monthly:

- Win rate at different S&R types

- Average risk/reward achieved

- Most profitable setups

- Common mistake patterns

- Best performing pairs/instruments

Conclusion

Support and resistance trading remains one of the most reliable approaches when executed with discipline and proper understanding. RelicusRoad Pro enhances this classic strategy by providing clear visual identification of key levels across multiple timeframes.

Key Takeaways:

- ✅ Think in zones, not lines

- ✅ Always wait for confirmation

- ✅ Respect major levels until proven broken

- ✅ Use proper risk management (1% rule)

- ✅ Combine S&R with other analysis tools

- ✅ Practice on demo before risking capital

- ✅ Keep a detailed trading journal

Remember: The best S&R traders are patient traders. Quality setups at major levels will always outperform quantity trading at minor levels.

Ready to enhance your support and resistance trading? Get RelicusRoad Pro and start identifying high-probability S&R zones with confidence.

About the Author

RelicusRoad Team

Expert trader and educator at RelicusRoad, sharing insights on advanced trading strategies and market analysis.

Related Articles

Action Levels Explained: Key Price Action Levels for Entry/Exit

Master RelicusRoad Pro's Action Levels for precise trade timing. Learn to identify critical price …

Daily Pivots Guide: Master Pivot Point Trading

Master RelicusRoad Pro's intelligent Daily Pivots system. Learn professional pivot trading …

MACD vs RSI: Which Indicator is Better?

Complete comparison of MACD and RSI indicators. Learn when to use each, their strengths, weaknesses, …