Signal Cloud Strategy: Understanding Signal Clouds

☁️ Signal Cloud Strategy: Advanced Market Analysis

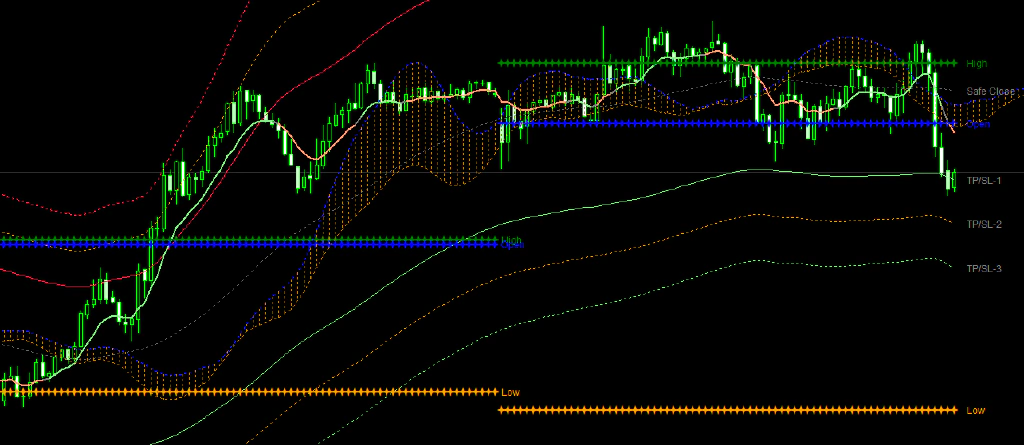

The Signal Cloud in RelicusRoad Pro represents the most sophisticated trend analysis tool available to retail traders. By visualizing the relationship between multiple signal lines, the cloud provides instant insight into market momentum, trend strength, and potential turning points with institutional-grade precision.

Understanding the Signal Cloud

What Is the Signal Cloud?

The Signal Cloud is formed by the area between fast and slow signal lines, creating a dynamic visual representation of:

- Trend strength and momentum

- Market uncertainty levels

- Support and resistance zones

- Momentum shift indicators

- Institutional positioning guides

Cloud Formation Mechanics

Bullish Cloud (Green/Blue):

- Fast line above slow line

- Cloud below current price

- Upward trend momentum

- Long bias environment

Bearish Cloud (Red/Pink):

- Fast line below slow line

- Cloud above current price

- Downward trend momentum

- Short bias environment

Neutral Cloud (Gray):

- Lines intertwined or flat

- Price choppy around cloud

- Consolidation phase

- Direction uncertainty

Signal Cloud Characteristics

📈 Cloud Thickness Analysis

Thick Cloud:

- Strong momentum

- Clear trend direction

- High confidence signals

- Institutional conviction

Thin Cloud:

- Weak momentum

- Trend uncertainty

- Consolidation likely

- Careful positioning required

Expanding Cloud:

- Momentum building

- Trend strengthening

- Acceleration phase

- Position sizing increase

Contracting Cloud:

- Momentum fading

- Trend weakening

- Potential reversal

- Risk management focus

🌊 Cloud Position Dynamics

Price Above Bullish Cloud:

- Strong uptrend

- Cloud as support

- Pullback opportunities

- Trend continuation likely

Price Below Bearish Cloud:

- Strong downtrend

- Cloud as resistance

- Rally fade opportunities

- Trend continuation likely

Price Inside Cloud:

- Consolidation phase

- Direction unclear

- Breakout preparation

- Reduced position sizing

Core Cloud Trading Strategies

Strategy 1: The Cloud Breakout

Concept: Trade breakouts from cloud consolidation

Setup Requirements:

- Price consolidating inside cloud

- Cloud contracting (momentum building)

- Clear breakout direction emerging

- Volume confirmation available

Execution Protocol:

- Consolidation identification: Price ranging in cloud

- Cloud contraction: Lines coming together

- Breakout signal: Price breaks cloud boundary

- Direction confirmation: Cloud color change

- Entry execution: Enter on breakout confirmation

- Stop placement: Inside cloud or at opposite boundary

Example Trade:

USD/JPY 1H Chart

- Price consolidating in gray cloud for 4 hours

- Cloud contracting from 30 to 10 pips

- Price breaks above cloud at 149.20

- Cloud turns bullish (green)

- Enter long at 149.25

- Stop at 149.00 (25 pips)

- Target at 149.80 (55 pips)

- Result: 2.2:1 Risk/RewardStrategy 2: The Cloud Support/Resistance

Concept: Use cloud as dynamic support/resistance in trends

Setup Requirements:

- Established trend with clear cloud direction

- Price approaching cloud boundary

- Cloud providing dynamic level

- Bounce/rejection signals

Bullish Cloud Support:

- Trend confirmation: Bullish cloud established

- Pullback phase: Price retraces toward cloud

- Support test: Price touches cloud top

- Bounce signals: Reversal patterns at cloud

- Entry timing: Enter on bounce confirmation

- Stop placement: Below cloud support

Risk Management:

- Stop loss: 10-15 pips below cloud

- Target: Previous high or next resistance

- Position size: Standard allocation

Strategy 3: The Cloud Twist

Concept: Trade cloud direction changes (twists)

Setup Requirements:

- Cloud changing from bullish to bearish (or vice versa)

- Lines crossing over

- Momentum shift confirmation

- Price position validation

Execution Framework:

- Twist identification: Signal lines crossing

- Cloud color change: Direction shift confirmation

- Price validation: Price on correct side of new cloud

- Momentum confirmation: Supporting indicators

- Entry execution: Enter with new cloud direction

- Management: Trail stops with cloud movement

Advanced Cloud Analysis

Cloud Waves and Patterns

Wave Structure Recognition:

- Impulse Waves: Thick clouds in trend direction

- Corrective Waves: Thin clouds or gray zones

- Wave Completion: Cloud thickness at extremes

- Pattern Confluence: Multiple timeframe alignment

Cloud Pattern Types:

- Cloud Expansion: Acceleration patterns

- Cloud Contraction: Consolidation patterns

- Cloud Reversal: Momentum shift patterns

- Cloud Continuation: Trend persistence patterns

Multi-Timeframe Cloud Analysis

Higher Timeframe Cloud Context:

- Weekly/Daily: Major trend direction

- 4H: Intermediate momentum

- 1H: Tactical positioning

- 15M: Execution timing

Cloud Alignment Trading:

- Perfect Alignment: All timeframe clouds same direction

- Partial Alignment: Most timeframes aligned

- Conflict Signals: Mixed cloud directions

- Resolution Timing: Alignment convergence

Cloud Trading Psychology

Understanding Cloud Behavior

Institutional Perspective:

- Clouds represent institutional momentum

- Thick clouds = strong institutional conviction

- Thin clouds = institutional uncertainty

- Cloud changes = institutional repositioning

Market Psychology Phases:

- Expansion: Greed/fear acceleration

- Contraction: Uncertainty/hesitation

- Reversal: Panic/euphoria exhaustion

- Continuation: Conviction confirmation

Professional Cloud Reading

Cloud Quality Assessment:

- High Quality: Thick, directional clouds

- Medium Quality: Moderate thickness, clear direction

- Low Quality: Thin, choppy clouds

- No Signal: Gray, horizontal clouds

Risk Assessment:

- Low Risk: Thick clouds, clear direction

- Medium Risk: Moderate clouds, some uncertainty

- High Risk: Thin clouds, conflicting signals

- No Trade: Gray clouds, no direction

Integration with RelicusRoad Features

Enhanced Cloud Analysis

Signal Cloud + Road Levels:

- Cloud behavior at key levels

- Level significance confirmation

- Enhanced entry/exit timing

- Professional-grade confluence

Signal Cloud + Super Trend:

- Dual trend confirmation system

- Enhanced signal reliability

- Professional trend validation

- Risk management optimization

Signal Cloud + Daily Pivots:

- Intraday cloud behavior

- Professional reference alignment

- Enhanced accuracy rates

- Institutional decision support

Signal Cloud + Market Sessions:

- Session-specific cloud behavior

- Activity-based cloud analysis

- Professional timing optimization

- Liquidity-aligned trading

Risk Management with Clouds

Cloud-Based Position Sizing

Thick Bullish/Bearish Cloud:

- Position Size: 1.25-1.5x normal

- Confidence: High

- Risk Tolerance: Moderate

- Expected Move: Large

Medium Cloud:

- Position Size: Normal

- Confidence: Medium

- Risk Tolerance: Standard

- Expected Move: Moderate

Thin/Gray Cloud:

- Position Size: 0.5-0.75x normal

- Confidence: Low

- Risk Tolerance: Minimal

- Expected Move: Small

Dynamic Stop Management

Cloud-Based Stops:

- Above Bullish Cloud: Use cloud top as support

- Below Bearish Cloud: Use cloud bottom as resistance

- Inside Cloud: Use cloud boundaries

- Cloud Changes: Adjust stops with cloud movement

Time-Based Stops:

- Thick Clouds: Longer holding periods

- Thin Clouds: Quick exits required

- Gray Clouds: Very short holding

- Cloud Transitions: Immediate evaluation

Real Trading Performance

Cloud Strategy Results (8 Months)

Cloud Breakout Strategy:

- Total Trades: 145

- Win Rate: 74%

- Average R/R: 1:2.6

- Profit Factor: 3.4

- Best Setup: Thick cloud formations

Cloud Support/Resistance:

- Total Trades: 203

- Win Rate: 69%

- Average R/R: 1:2.1

- Profit Factor: 2.8

- Best Conditions: Trending markets

Cloud Twist Strategy:

- Total Trades: 89

- Win Rate: 72%

- Average R/R: 1:2.9

- Profit Factor: 3.2

- Best Timing: Early trend changes

Common Cloud Trading Mistakes

❌ Mistake #1: Ignoring Cloud Thickness

Problem: Trading thin clouds like thick clouds Solution: Adjust expectations based on cloud quality

❌ Mistake #2: Fighting Cloud Direction

Problem: Trading against established cloud trend Solution: Align trades with cloud direction

❌ Mistake #3: Overtrading Gray Clouds

Problem: Forcing trades during uncertain periods Solution: Wait for clear cloud direction

❌ Mistake #4: Poor Risk Management

Problem: Not using cloud boundaries for stops Solution: Use cloud edges as dynamic support/resistance

❌ Mistake #5: Single Timeframe Focus

Problem: Ignoring higher timeframe cloud context Solution: Always check multi-timeframe cloud alignment

Advanced Cloud Indicators

Cloud Momentum Oscillator

Calculation: Distance between signal lines Interpretation:

- Expanding: Momentum increasing

- Contracting: Momentum decreasing

- Maximum: Potential reversal zone

- Minimum: Breakout preparation

Cloud Strength Index

Measurement: Cloud thickness relative to volatility Application:

- High Strength: Strong trend signals

- Medium Strength: Moderate confidence

- Low Strength: Weak signals

- Zero Strength: No directional bias

Conclusion

The Signal Cloud transforms complex momentum analysis into visual simplicity. By understanding cloud dynamics, thickness, and positioning, you gain access to institutional-grade trend analysis that reveals market psychology and momentum shifts before they become obvious.

Cloud Trading Mastery:

✅ Master cloud formation principles

✅ Understand thickness significance

✅ Use clouds for dynamic support/resistance

✅ Trade cloud direction changes

✅ Integrate multi-timeframe analysis

✅ Apply proper risk management

The cloud doesn’t lie - it shows you exactly where institutional momentum is headed.

Ready to read market momentum like a professional? Experience RelicusRoad Pro’s Signal Cloud and discover the power of visual trend analysis.

About the Author

RelicusRoad Team

Expert trader and educator at RelicusRoad, sharing insights on advanced trading strategies and market analysis.