Detailed IC Markets review covering spreads, regulation, platforms, and user experience. Is it the right broker for you?

IC Markets Review 2024: Complete Analysis

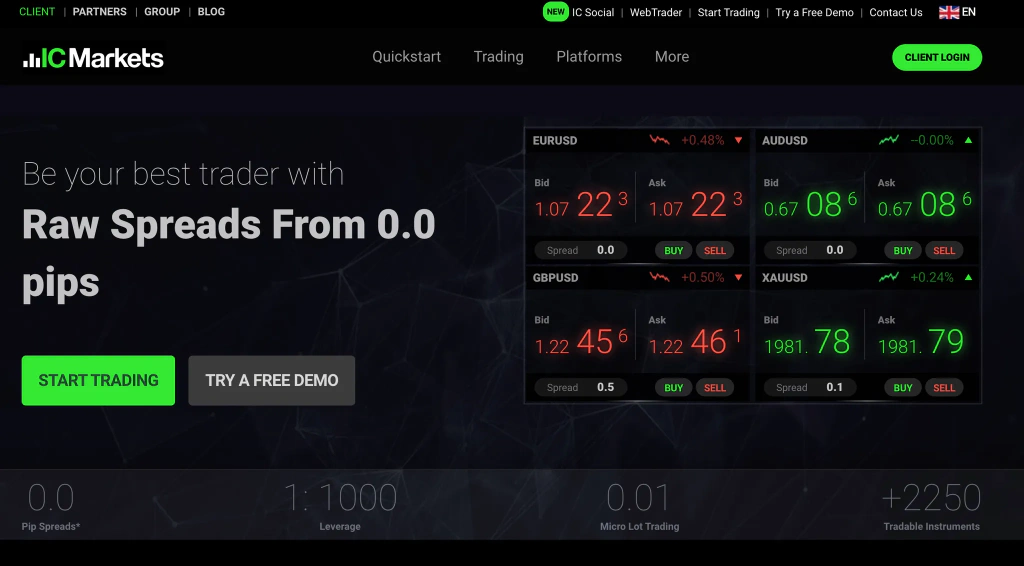

IC Markets has built a reputation as one of the top ECN brokers. This comprehensive review examines their offerings, costs, and whether they’re right for your trading needs.

IC Markets Overview

- Founded: 2007

- Headquarters: Sydney, Australia

- Regulation: ASIC, CySEC, FSA

- Minimum Deposit: $200

- Account Types: Standard, Raw Spread, cTrader

⭐ Rating: 4.8/5

What We Love

- Ultra-tight spreads

- Lightning-fast execution

- Multiple platforms

- Strong regulation

Areas for Improvement

- Higher minimum deposit

- Complex for beginners

- Limited educational content

Spreads & Commissions

Raw Spread Account

- EUR/USD: From 0.1 pips + $3.5 commission

- GBP/USD: From 0.3 pips + $3.5 commission

- USD/JPY: From 0.2 pips + $3.5 commission

Standard Account

- EUR/USD: From 1.0 pips

- GBP/USD: From 1.5 pips

- USD/JPY: From 1.2 pips

Trading Platforms

MetaTrader 4

- Pros: Stable, familiar, lots of EAs

- Cons: Older technology

- Best For: Automated trading

MetaTrader 5

- Pros: Modern features, hedging

- Cons: Fewer EAs available

- Best For: Advanced analysis

cTrader

- Pros: Modern UI, Level II pricing

- Cons: Learning curve

- Best For: Professional traders

Regulation & Safety

ASIC (Australia) ⭐⭐⭐⭐⭐

- Client funds: Segregated

- Compensation: Up to $20,000

- Oversight: Strict monitoring

CySEC (Cyprus) ⭐⭐⭐⭐☆

- Client funds: Segregated

- Compensation: Up to €20,000

- Oversight: EU standards

Account Types Comparison

| Feature | Standard | Raw Spread | cTrader |

|---|---|---|---|

| Min Deposit | $200 | $200 | $200 |

| Spreads | From 1.0 | From 0.1 | From 0.1 |

| Commission | No | $3.5/lot | $3/lot |

| Platform | MT4/MT5 | MT4/MT5 | cTrader |

Entry 1

Feature

Min Deposit

Standard

$200

Raw Spread

$200

cTrader

$200

Entry 2

Feature

Spreads

Standard

From 1.0

Raw Spread

From 0.1

cTrader

From 0.1

Entry 3

Feature

Commission

Standard

No

Raw Spread

$3.5/lot

cTrader

$3/lot

Entry 4

Feature

Platform

Standard

MT4/MT5

Raw Spread

MT4/MT5

cTrader

cTrader

Trading Conditions

Execution

- Type: ECN/STP

- Speed: Average 40ms

- Slippage: Minimal

- Requotes: Rare

Leverage

- Forex: Up to 1:500

- Indices: Up to 1:200

- Commodities: Up to 1:100

Pros & Cons

✅ Pros

- Ultra-tight spreads: Best in industry

- Fast execution: Perfect for scalping

- Strong regulation: Multiple jurisdictions

- Professional platforms: MT4, MT5, cTrader

- Deep liquidity: Tier-1 providers

❌ Cons

- Higher barriers: $200 minimum

- Complex pricing: Commission structure

- Limited education: Fewer learning resources

- Not beginner-friendly: Overwhelming features

Who Should Choose IC Markets?

✅ Perfect For

- Experienced traders

- Scalpers and day traders

- EA developers

- High-frequency traders

- Professional traders

❌ Not Ideal For

- Complete beginners

- Small account traders

- Education seekers

- Simple platform users

Customer Support

Contact Options

- Live Chat: 24/5

- Email: Response within 24h

- Phone: Multiple countries

- Languages: 11 supported

Quality Rating: ⭐⭐⭐⭐☆

- Professional and knowledgeable

- Quick response times

- Technical expertise

Mobile Trading

MT4/MT5 Mobile

- Features: Full functionality

- Performance: Smooth and stable

- Charts: Professional quality

cTrader Mobile

- Features: Advanced tools

- Performance: Excellent

- Interface: Modern design

Educational Resources

Available Content

- Basic trading guides

- Platform tutorials

- Market analysis

- Economic calendar

Rating: ⭐⭐⭐☆☆

Limited compared to other brokers, but quality is good.

Deposits & Withdrawals

Deposit Methods

- Bank Transfer: Free

- Credit/Debit Cards: Instant

- PayPal: Selected regions

- Skrill/Neteller: Available

Withdrawal Times

- Bank Transfer: 1-3 business days

- Cards: 1-3 business days

- E-wallets: Same day

Security Features

Account Protection

- Two-factor authentication

- SSL encryption

- Negative balance protection

- Segregated client funds

Final Verdict

Score: 4.8/5 ⭐⭐⭐⭐⭐

IC Markets excels in execution speed, spreads, and regulation. It’s ideal for experienced traders who prioritize cost-effectiveness and professional tools.

Bottom Line

If you’re an experienced trader looking for institutional-grade conditions, IC Markets is hard to beat. Beginners should consider starting elsewhere and graduating to IC Markets later.

Alternatives to Consider

- For Beginners: XM, Oanda

- For Education: IG, FXTM

- For Low Deposits: XM, Exness

Share this article:

About the Author

B

BrokerExpert

Expert trader and educator at RelicusRoad, sharing insights on advanced trading strategies and market analysis.