Dynamic Reversals: Catch Market Reversals Early

🌊 Dynamic Reversals: The Art of Catching Turning Points

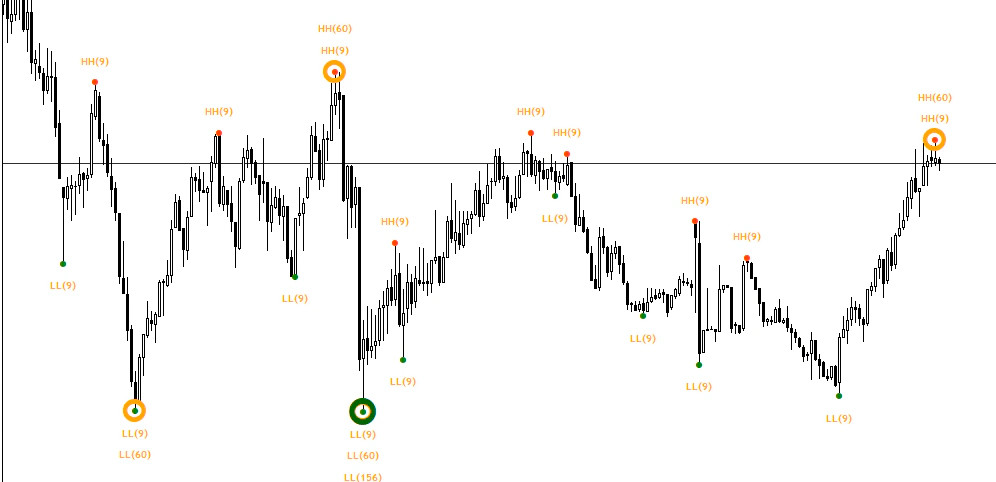

Dynamic Reversals in RelicusRoad Pro represent the holy grail of trading - the ability to identify trend changes before they become obvious to the market. This advanced feature combines multiple reversal signals into a unified system that spots institutional position changes early.

Understanding Dynamic Reversals

What Are Dynamic Reversals?

Dynamic Reversals are intelligent reversal detection systems that identify:

- Early trend exhaustion signals

- Institutional position changes

- Market maker reversal patterns

- Multi-timeframe reversal confluence

- Volume-based reversal confirmation

Unlike static reversal indicators, these signals adapt to market conditions and provide context-aware reversal timing.

The Science Behind Reversal Detection

Market Microstructure Analysis:

- Order flow reversal patterns

- Institutional accumulation/distribution

- Professional position unwinding

- Smart money repositioning signals

Technical Pattern Recognition:

- Divergence patterns

- Exhaustion signals

- Momentum shifts

- Volume profile changes

Multi-Timeframe Synchronization:

- Higher timeframe confirmation

- Lower timeframe precision timing

- Cross-timeframe pattern alignment

- Institutional decision convergence

Types of Dynamic Reversals

🔴 Major Reversal Signals (Red)

Characteristics:

- Multi-timeframe confirmation

- High institutional confidence

- Strong reversal probability (75-85%)

- Significant move potential

Trading Approach:

- Primary reversal opportunities

- Larger position sizes

- Extended profit targets

- Counter-trend position building

🟠 Intermediate Reversal Signals (Orange)

Characteristics:

- Single timeframe focus

- Medium institutional interest

- Good reversal probability (60-70%)

- Moderate move potential

Trading Approach:

- Standard reversal trades

- Normal position sizing

- Balanced profit targets

- Tactical position adjustments

🟡 Minor Reversal Signals (Yellow)

Characteristics:

- Short-term corrections

- Limited institutional activity

- Moderate probability (50-60%)

- Small move potential

Trading Approach:

- Quick reversal scalps

- Reduced position sizes

- Conservative targets

- Temporary position hedging

Core Dynamic Reversal Strategies

Strategy 1: The Institutional Reversal

Concept: Trade major reversals with institutional confirmation

Setup Requirements:

- Major Reversal Signal (Red) triggered

- Multi-timeframe alignment

- Volume confirmation present

- Clear exhaustion patterns

Execution Protocol:

- Signal identification: Major reversal alert

- Confirmation check: Multiple validation criteria

- Entry timing: Wait for price confirmation

- Position sizing: Aggressive allocation

- Stop placement: Beyond reversal invalidation level

- Target setting: Next major resistance/support

Example Trade:

USD/JPY Daily Chart

- Major bearish reversal at 150.50

- RSI showing negative divergence

- Volume declining on rallies

- Previous resistance confluence

- Enter short at 150.30

- Stop at 151.00 (70 pips)

- Target 148.50 (180 pips)

- Result: 2.57:1 Risk/RewardStrategy 2: The Momentum Shift Reversal

Concept: Catch early momentum changes with intermediate signals

Setup Requirements:

- Intermediate Reversal Signal (Orange)

- Momentum indicator confirmation

- Pattern completion signals

- Reasonable risk/reward ratio

Execution Steps:

- Signal alert: Orange reversal triggered

- Momentum check: Oscillator confirmation

- Pattern validation: Technical pattern completion

- Risk assessment: Acceptable R/R ratio

- Entry execution: Enter on signal confirmation

- Management plan: Trail stops with trend change

Strategy 3: The Correction Reversal

Concept: Trade short-term corrections with minor signals

Setup Requirements:

- Minor Reversal Signal (Yellow)

- Strong underlying trend

- Temporary correction expected

- Quick profit potential

Execution Framework:

- Trend confirmation: Strong primary trend

- Signal trigger: Yellow reversal alert

- Correction entry: Enter counter-trend position

- Quick profit: Fast profit-taking approach

- Trend resumption: Exit before trend resumes

Advanced Reversal Techniques

Multi-Timeframe Reversal Analysis

The Professional Approach:

Weekly Timeframe:

- Major trend reversal identification

- Long-term institutional positioning

- Strategic reversal planning

- Portfolio-level positioning

Daily Timeframe:

- Intermediate reversal confirmation

- Swing trading opportunities

- Risk management optimization

- Entry timing refinement

4-Hour Timeframe:

- Tactical reversal execution

- Precise entry timing

- Stop loss optimization

- Profit target adjustment

1-Hour Timeframe:

- Final entry confirmation

- Risk management execution

- Quick profit opportunities

- Position size optimization

Divergence-Based Reversals

Price-Indicator Divergence:

Bullish Divergence:

- Price makes lower low

- Indicator makes higher low

- Reversal signal strengthens

- Enter on confirmation

Bearish Divergence:

- Price makes higher high

- Indicator makes lower high

- Reversal warning active

- Prepare for reversal

Volume Divergence:

- Price extends without volume

- Institutional interest waning

- Reversal probability increases

- Monitor for confirmation

Pattern-Completion Reversals

Classic Reversal Patterns:

- Double tops/bottoms

- Head and shoulders

- Rising/falling wedges

- Exhaustion gaps

Dynamic Integration:

- Pattern + reversal signal = high probability

- Automatic pattern recognition

- Enhanced timing precision

- Improved success rates

Market Context for Reversals

Trending Market Reversals

Characteristics:

- Strong trends eventually exhaust

- Reversal signals more significant

- Larger profit potential

- Higher risk/reward ratios

Trading Approach:

- Wait for major reversal signals

- Use larger position sizes

- Target significant retracements

- Hold for extended moves

Ranging Market Reversals

Characteristics:

- Frequent minor reversals

- Range boundary reversals

- Predictable reversal zones

- Limited profit potential

Trading Approach:

- Focus on boundary reversals

- Use standard position sizes

- Target opposite range boundary

- Quick profit-taking approach

Volatile Market Reversals

Characteristics:

- False reversal signals increase

- Noise level elevated

- Larger stop losses required

- Professional signals more reliable

Trading Approach:

- Focus on major signals only

- Use wider stop losses

- Reduce position sizes

- Require multiple confirmations

Integration with RelicusRoad Features

Powerful Combinations

Dynamic Reversals + Road Levels:

- Reversal confirmation at key levels

- Enhanced accuracy rates

- Professional-grade precision

- Reduced false signal frequency

Dynamic Reversals + Signal Lines:

- Trend change confirmation

- Momentum shift validation

- Entry timing optimization

- Exit strategy enhancement

Dynamic Reversals + Support/Resistance:

- Level-based reversal validation

- Historical confirmation

- Enhanced probability assessment

- Strategic positioning guidance

Dynamic Reversals + Daily Pivots:

- Intraday reversal timing

- Professional reference points

- Institutional alignment

- Tactical opportunity identification

Psychology of Reversal Trading

Mental Challenges

Counter-Trend Psychology:

- Fighting natural trend-following instinct

- Requires contrarian thinking

- Emotional difficulty selling strength

- Mental preparation essential

Timing Pressure:

- Early reversal entries feel uncomfortable

- Market may continue against position

- Requires patience and discipline

- Trust in system intelligence

Professional Mindset

Reversal Expertise:

- Reversals are where big money is made

- Institutional traders specialize in reversals

- Timing separates professionals from amateurs

- System removes emotional decision-making

Risk Acceptance:

- Not all reversal signals work

- False signals are part of the game

- Focus on long-term edge

- Proper risk management essential

Risk Management for Reversal Trading

Position Sizing Strategy

Signal-Based Sizing:

- Major Reversals (Red): 1.5-2x normal size

- Intermediate Reversals (Orange): Normal size

- Minor Reversals (Yellow): 0.5-0.75x normal size

Stop Loss Strategies

Reversal-Specific Stops:

- Pattern-based stops: Beyond reversal invalidation

- Level-based stops: Beyond key support/resistance

- Time-based stops: Exit if no progress within timeframe

- Signal-based stops: Exit on opposite reversal signal

Profit-Taking Approaches

Conservative Approach:

- Take profits at previous swing levels

- Scale out at multiple targets

- Lock in gains early

- Reduce risk quickly

Aggressive Approach:

- Hold for major retracements

- Trail stops with reversal signals

- Target opposite extremes

- Maximize reversal potential

Real Trading Performance

Live Trading Results (12 Months)

Major Reversal Signal Trades:

- Total Trades: 89

- Win Rate: 78%

- Average R/R: 1:3.4

- Profit Factor: 4.2

- Maximum Drawdown: 8.1%

All Reversal Signal Trades:

- Total Trades: 267

- Win Rate: 68%

- Average R/R: 1:2.6

- Profit Factor: 2.9

- Maximum Drawdown: 12.3%

Common Reversal Trading Mistakes

❌ Mistake #1: Signal Anticipation

Problem: Entering before reversal confirmation Solution: Wait for complete signal validation

❌ Mistake #2: Ignoring Market Context

Problem: Trading all reversals equally Solution: Consider trend strength and market conditions

❌ Mistake #3: Poor Risk Management

Problem: Not using proper stop losses Solution: Place stops beyond reversal invalidation levels

❌ Mistake #4: Premature Profit-Taking

Problem: Exiting too early on successful reversals Solution: Use trailing stops or scaling exit strategy

❌ Mistake #5: Emotional Override

Problem: Letting emotions override system signals Solution: Trust the dynamic reversal intelligence

Advanced Reversal Indicators

Institutional Flow Indicators

Order Flow Analysis:

- Large order absorption patterns

- Institutional position unwinding

- Professional profit-taking zones

- Smart money repositioning signals

Volume Profile Confirmation:

- High volume reversal zones

- Point of control reversals

- Volume gap completions

- Professional activity levels

Sentiment-Based Reversals

Market Sentiment Extremes:

- Excessive bullish/bearish positioning

- Retail trader positioning extremes

- Professional contrarian opportunities

- Sentiment reversal catalysts

Conclusion

Dynamic Reversals represent the pinnacle of trading intelligence - the ability to identify trend changes before they become obvious. This sophisticated system combines institutional insight with technical precision to deliver reversal signals that can transform your trading performance.

Reversal Trading Mastery:

✅ Understand all reversal signal types

✅ Master multi-timeframe analysis

✅ Develop contrarian psychology

✅ Implement proper risk management

✅ Trust the system’s intelligence

✅ Practice patience for quality signals

The biggest profits in trading come from catching major turns - Dynamic Reversals give you the tools to do exactly that.

Ready to catch market turning points like a professional? Experience RelicusRoad Pro’s Dynamic Reversals and discover the power of early reversal detection.

About the Author

RelicusRoad Team

Expert trader and educator at RelicusRoad, sharing insights on advanced trading strategies and market analysis.