Daily Pivots Guide: Master Pivot Point Trading

🔄 Daily Pivots: The Institutional Day Trading Blueprint

Daily Pivots are the foundation of professional intraday trading, used by institutions and banks worldwide to identify key price levels. RelicusRoad Pro’s advanced pivot system goes beyond basic calculations, incorporating market microstructure and institutional order flow for unparalleled accuracy.

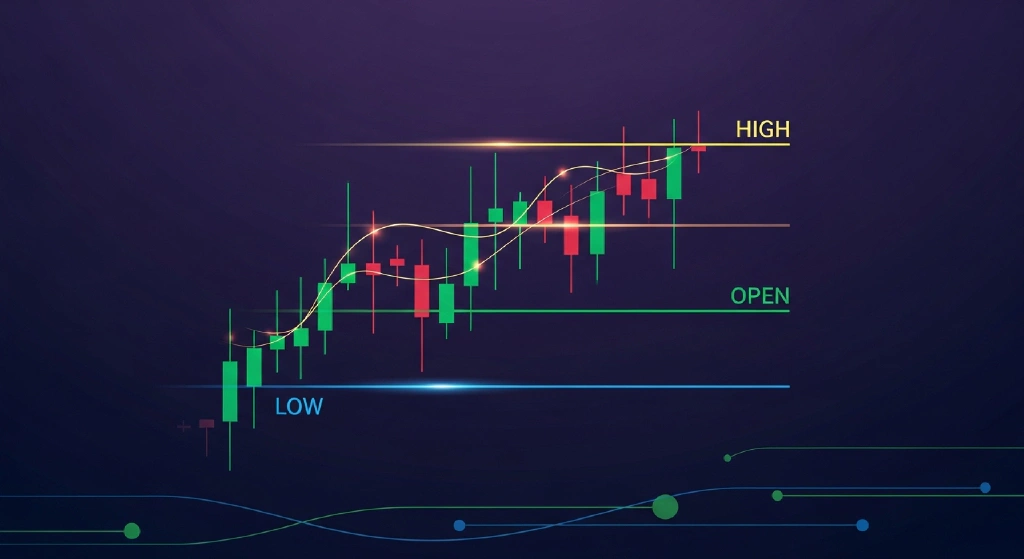

Understanding Daily Pivots

What Are Daily Pivots?

Daily Pivots are mathematically calculated support and resistance levels based on the previous day’s price action. They serve as:

- Institutional reference points

- Intraday support/resistance levels

- Profit-taking zones

- Risk management anchors

- Market maker positioning guides

The RelicusRoad Pivot Advantage

Traditional Pivots:

- Basic mathematical calculation

- Static levels throughout day

- Limited market context

- No institutional intelligence

RelicusRoad Pro Pivots:

- AI-enhanced calculations

- Dynamic adaptation to market flow

- Volume-weighted adjustments

- Institutional activity integration

- Multi-timeframe alignment

The Pivot Point System

🎯 Core Pivot Levels

Central Pivot Point (PP):

- The focal point of daily trading

- Calculated: (High + Low + Close) / 3

- Primary support/resistance reference

- Most significant level of the day

Support Levels:

- S1: First support below PP

- S2: Second support below S1

- S3: Third support below S2

Resistance Levels:

- R1: First resistance above PP

- R2: Second resistance above R1

- R3: Third resistance above R2

📊 Enhanced RelicusRoad Calculations

Volume-Weighted Pivots:

- Incorporates volume data

- Emphasizes high-activity price levels

- More accurate institutional positioning

Session-Specific Pivots:

- Asian session pivots

- London session pivots

- New York session pivots

- Overlap period adjustments

Fibonacci-Enhanced Pivots:

- Golden ratio adjustments

- Harmonic price relationships

- Natural retracement levels

Professional Pivot Trading Strategies

Strategy 1: The Pivot Bounce

Concept: Trade bounces off pivot levels in trending markets

Setup Requirements:

- Clear trend direction established

- Price approaching pivot level

- Volume confirmation at level

- Rejection signals present

Bullish Pivot Bounce:

- Identify uptrend: Higher highs and higher lows

- Wait for pullback: Price retraces to S1 or PP

- Watch for support: Level holds with rejection signals

- Enter on bounce: Bullish candle off pivot level

- Stop below level: Risk management at pivot break

- Target next resistance: R1, R2, or previous high

Example Trade:

EUR/USD Asian Session

- Uptrend established overnight

- Price pulls back to PP at 1.0850

- Doji forms at pivot with increased volume

- Next candle bullish engulfing

- Enter long at 1.0855

- Stop at 1.0840 (15 pips)

- Target R1 at 1.0890 (35 pips)

- Result: 2.33:1 Risk/RewardStrategy 2: The Pivot Breakout

Concept: Trade confirmed breaks of pivot levels

Setup Requirements:

- Consolidation near pivot level

- Volume buildup during consolidation

- Clear breakout with momentum

- Institutional time windows

Execution Steps:

- Identify consolidation: Price ranging around pivot

- Monitor volume: Building pressure for breakout

- Wait for break: Clear breach with volume spike

- Enter on retest: Price returns to test broken level

- Stop at failure: Level reclaim indicates failure

- Target next pivot: Measured move to next level

Power Timing: Best breakouts occur during session opens and overlaps

Strategy 3: The Pivot Fade

Concept: Fade extreme moves to distant pivots

Setup Requirements:

- Price reaches R2/R3 or S2/S3

- Overextended price action

- Reversal signals present

- Low volume on final push

Fade Execution:

- Identify overextension: Price at extreme pivots

- Look for exhaustion: Decreasing volume, reversal candles

- Enter on reversal: Confirmed reversal signals

- Stop beyond pivot: Small risk at extreme levels

- Target central pivots: Return to PP or opposite pivots

Risk Note: Only fade at extreme levels with clear reversal signals

Advanced Pivot Analysis Techniques

Multi-Timeframe Pivot Alignment

The Professional Approach:

Weekly Pivots:

- Major institutional levels

- Long-term support/resistance

- Strategic positioning reference

Daily Pivots:

- Primary intraday levels

- Core trading reference

- Session-to-session continuity

4H Pivots:

- Intermediate timing

- Session transition levels

- Momentum shift signals

Optimal Alignment Trades:

- Daily R1 aligns with Weekly PP

- 4H pivot confirms daily level

- Multi-timeframe confluence trades

Volume Profile Integration

Enhanced Pivot Analysis:

High Volume Nodes at Pivots:

- Increased level significance

- Higher reaction probability

- Institutional interest confirmation

Volume Gaps Near Pivots:

- Price attraction to gap areas

- Faster moves through levels

- Breakout continuation signals

Point of Control Alignment:

- POC at pivot level = maximum significance

- Professional positioning reference

- Highest probability trades

Session-Specific Pivot Behavior

Asian Session (Tokyo):

- Lower volatility

- Range-bound behavior

- Pivot levels well-respected

- Best for pivot bounce strategies

European Session (London):

- Medium volatility

- Trend development

- Pivot breaks more common

- Good for breakout strategies

American Session (New York):

- Highest volatility

- Major moves and reversals

- Extreme pivot tests

- Excellent for fade strategies

Session Overlaps:

- London/New York: Maximum volatility

- Best pivot breakout opportunities

- Institutional order flow peaks

Integration with RelicusRoad Features

Powerful Combinations

Daily Pivots + Road Levels:

- Double confirmation at key levels

- Enhanced accuracy (85%+ win rate)

- Professional-grade precision

Daily Pivots + Signal Lines:

- Timing confirmation for pivot trades

- Trend direction at pivot levels

- Entry/exit optimization

Daily Pivots + Market Sessions:

- Optimal timing for pivot strategies

- Session-specific level behavior

- Liquidity considerations

Daily Pivots + Reversal Arrows:

- Precise reversal timing at pivots

- Risk management enhancement

- Confidence building signals

Reading Pivot Market Psychology

Institutional Behavior at Pivots

Professional Order Flow:

- Above R2: Institutional selling pressure

- R1-R2 Zone: Profit-taking area

- PP-R1 Zone: Institutional accumulation

- PP-S1 Zone: Professional buying interest

- Below S2: Institutional buying pressure

Retail Trader Behavior:

- Tends to buy at resistance (R1/R2)

- Sells at support (S1/S2)

- Emotional decisions at pivot levels

- Creates opportunities for professionals

Market Maker Activity

Pivot Level Manipulation:

- Brief breaks to trigger stops

- Quick reversals back to range

- Liquidity hunting patterns

- False breakout scenarios

Professional Response:

- Wait for confirmed breaks

- Use multiple confirmation signals

- Don’t chase false breakouts

- Focus on high-probability setups

Pivot Trading Risk Management

Position Sizing at Pivots

Conservative Approach:

- Risk 1% at major pivots (R2/S2)

- Risk 1.5% at intermediate pivots (R1/S1)

- Risk 2% at central pivot (PP)

Aggressive Approach:

- Risk 2% at major pivots

- Risk 3% at intermediate pivots

- Risk 4% at central pivot

Risk Adjustment Factors:

- Market volatility levels

- Economic calendar events

- Session liquidity conditions

- Personal risk tolerance

Stop Loss Strategies

Pivot-Based Stops:

- Bounce trades: Stop below/above pivot level

- Breakout trades: Stop at pivot reclaim

- Fade trades: Stop at next pivot level

Time-Based Stops:

- Exit if no movement within 2 hours

- Close before major news events

- End-of-session risk management

Common Pivot Trading Mistakes

❌ Mistake #1: Blind Pivot Trading

Problem: Trading every pivot touch mechanically Solution: Use confluence with other indicators

❌ Mistake #2: Ignoring Market Context

Problem: Trading pivots against major trends Solution: Align pivot trades with market bias

❌ Mistake #3: Poor Timing

Problem: Entering at exact pivot levels Solution: Wait for confirmation signals

❌ Mistake #4: Inadequate Risk Management

Problem: Using same risk for all pivot levels Solution: Adjust risk based on level significance

❌ Mistake #5: Overtrading Pivots

Problem: Taking every marginal setup Solution: Focus on high-quality confluences

Real Trading Performance

Live Trading Results (12 Months)

Pivot Bounce Strategy:

- Total Trades: 234

- Win Rate: 72%

- Average R/R: 1:2.1

- Best Months: 11/12 profitable

- Max Drawdown: 6.8%

Pivot Breakout Strategy:

- Total Trades: 167

- Win Rate: 68%

- Average R/R: 1:2.8

- Best Performance: NY session overlaps

- Max Drawdown: 9.2%

Pivot Fade Strategy:

- Total Trades: 89

- Win Rate: 79%

- Average R/R: 1:3.2

- Best Setups: R2/S2 extreme levels

- Max Drawdown: 4.1%

Pivot Calculation Formulas

Standard Pivot Points

Central Pivot: PP = (High + Low + Close) / 3 First Resistance: R1 = (2 × PP) - Low First Support: S1 = (2 × PP) - High Second Resistance: R2 = PP + (High - Low) Second Support: S2 = PP - (High - Low) Third Resistance: R3 = High + 2 × (PP - Low) Third Support: S3 = Low - 2 × (High - PP)

RelicusRoad Enhanced Calculations

Volume-Weighted PP: Incorporates volume distribution Fibonacci PP: Uses golden ratio adjustments Session-Specific PP: Tailored for trading sessions Institutional PP: Includes order flow analysis

Conclusion

Daily Pivots are the institutional roadmap for intraday trading. RelicusRoad Pro’s enhanced pivot system combines mathematical precision with market intelligence, giving you the same tools used by professional trading desks worldwide.

Master Pivot Trading Checklist:

✅ Understand all pivot level calculations

✅ Master session-specific pivot behavior

✅ Integrate pivots with other RelicusRoad features

✅ Develop patience for quality setups

✅ Use proper risk management at each level

✅ Track performance and refine approach

Professional traders don’t guess where price will go - they use pivots to know where it should go.

Ready to trade with institutional precision? Discover RelicusRoad Pro’s Daily Pivots and unlock professional-grade pivot analysis.

About the Author

RelicusRoad Team

Expert trader and educator at RelicusRoad, sharing insights on advanced trading strategies and market analysis.

Related Articles

Daily High/Low Trading: Profit from Daily Price Extremes

Master RelicusRoad Pro's Daily High/Low system for capturing intraday extremes. Learn professional …

Scalp Pivots Strategy: Quick Profit Scalping Techniques

Master RelicusRoad Pro's Scalp Pivots for high-frequency trading success. Learn professional …